TURN YOUR IDEA INTO AN EMPIRE

Seize growth opportunities, simplify operations

and save smarter—all from one powerful platform.

Here's why SMEs love Wio

Opening an account faster than fast

Apply online today—get started in just 3 working days, no minimum balance, and 24/7 customer support for your business.

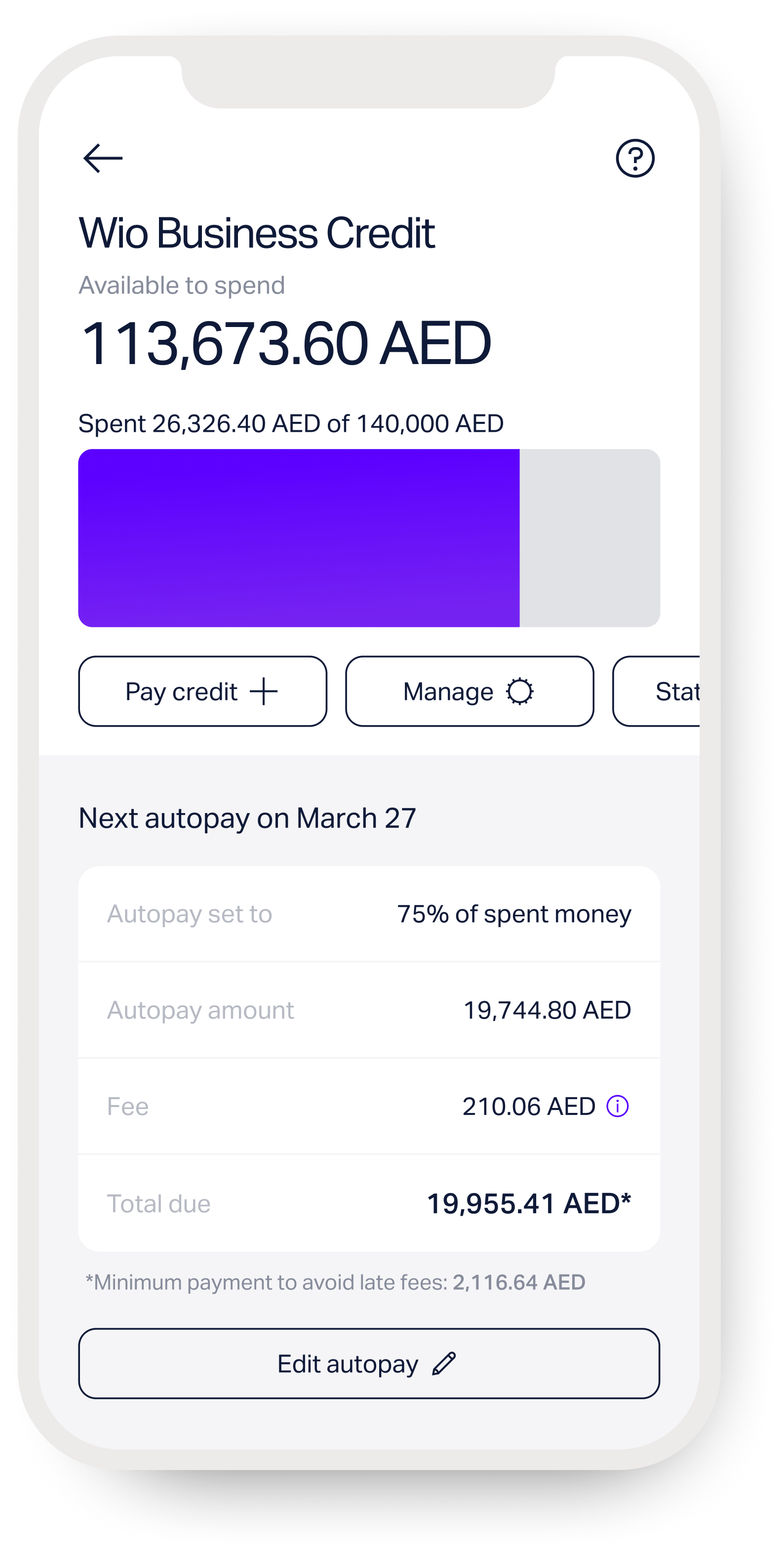

Your business ideas deserve credit

Get up to AED 250,000 in credit, use it interest-free for 60 days, and earn 2% cashback—all approved online in 3 working days.

Cash when

you need it

Convert your credit into cash with no heavy charges, just daily fees from AED 1.50—flexible and perfect for short-term needs.

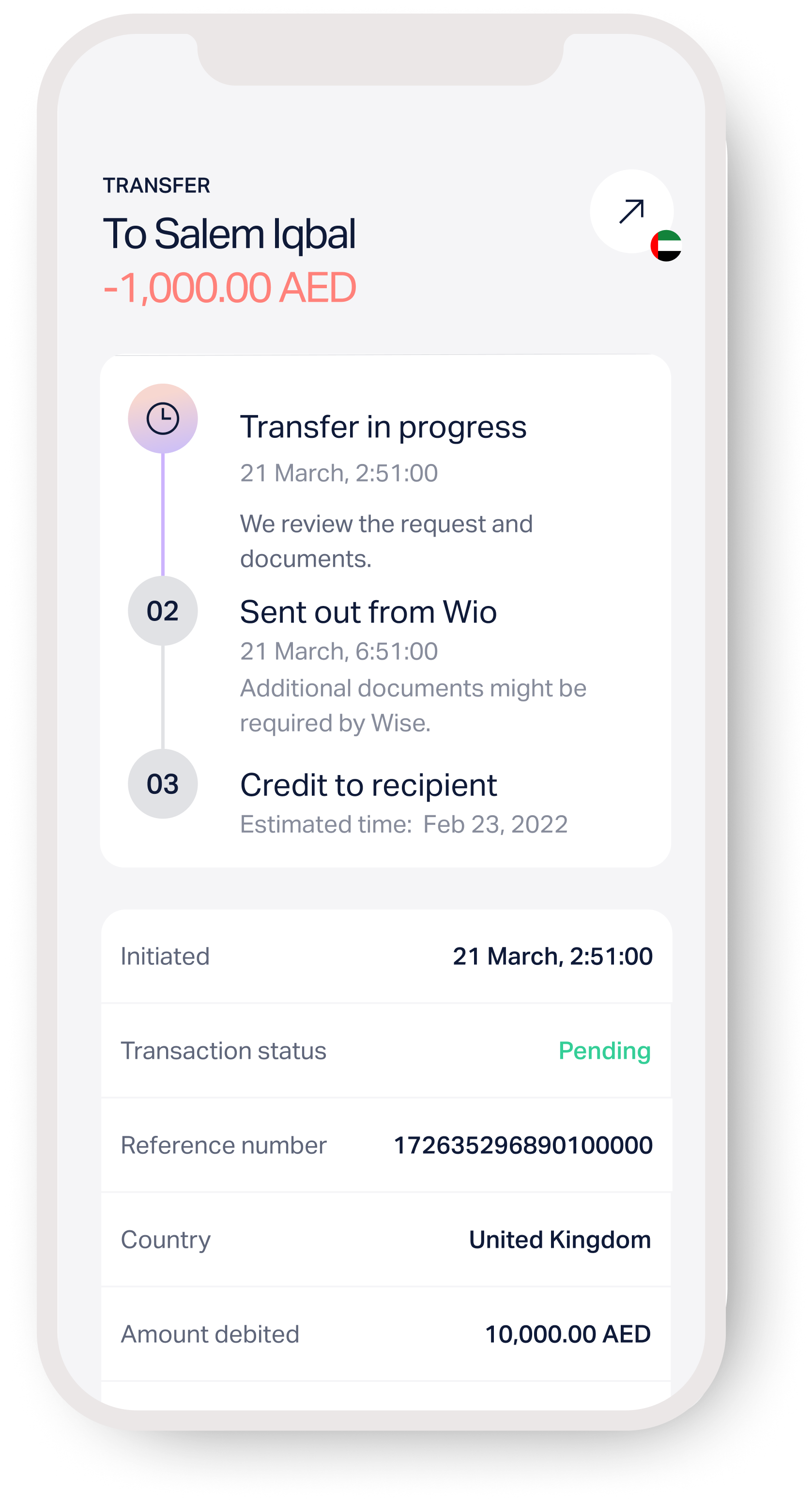

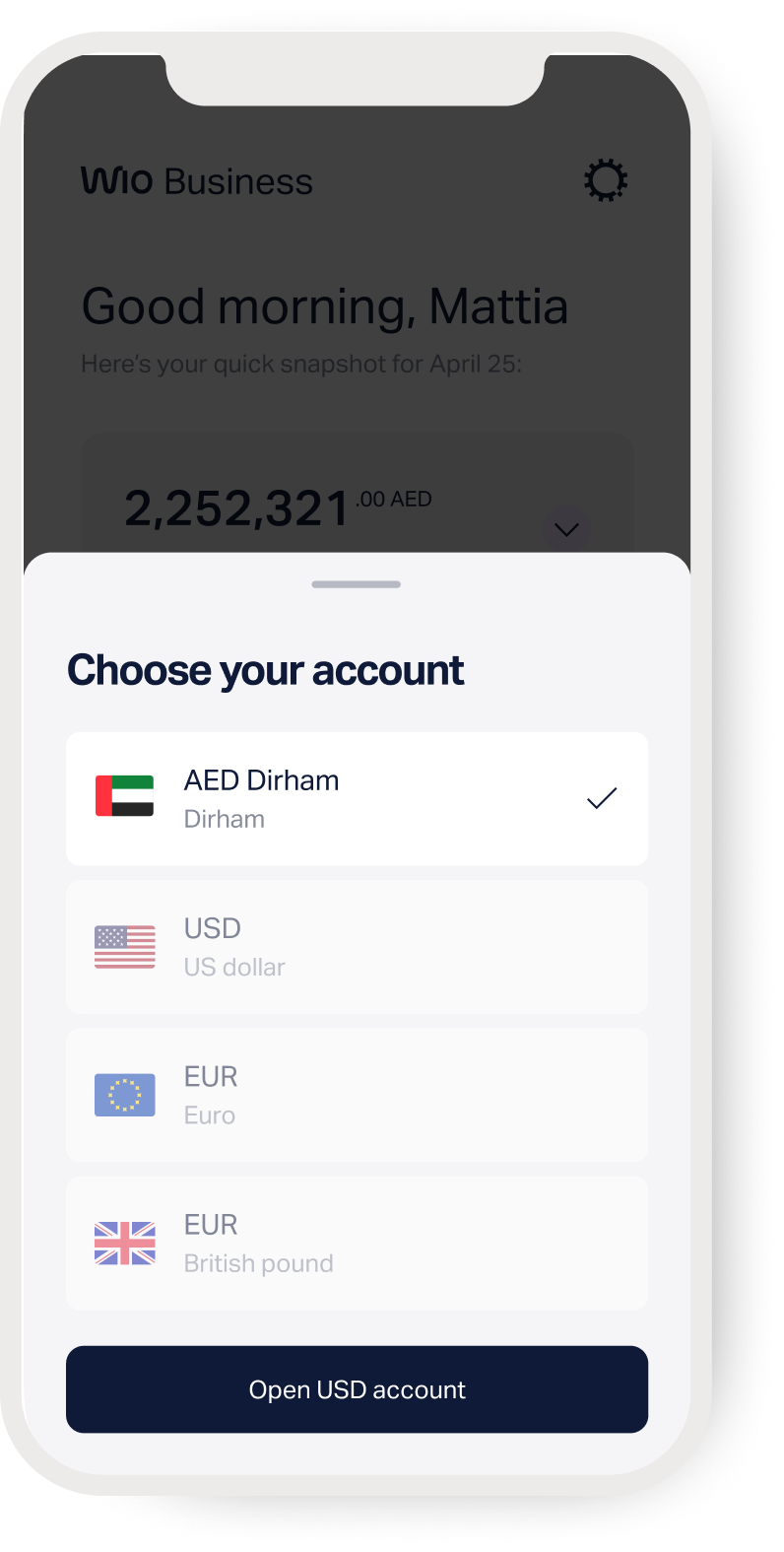

Your fast pass to global markets

Get up to 3 free accounts in USD, GBP, EUR, and AED instantly online. Plus, fast transfers and the best FX rates—guaranteed AED to USD at 3.673.

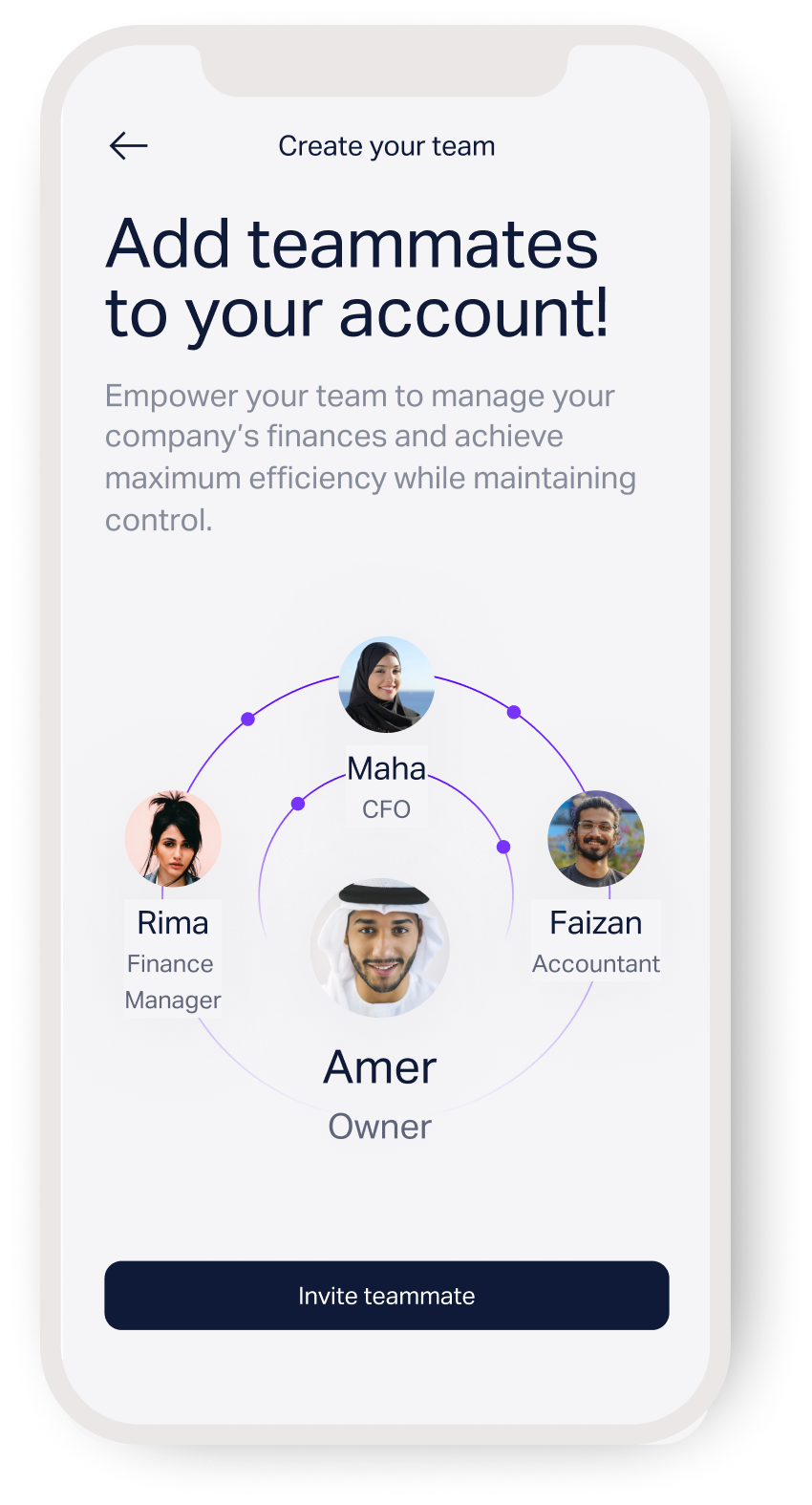

Take the hassle out of the hustle

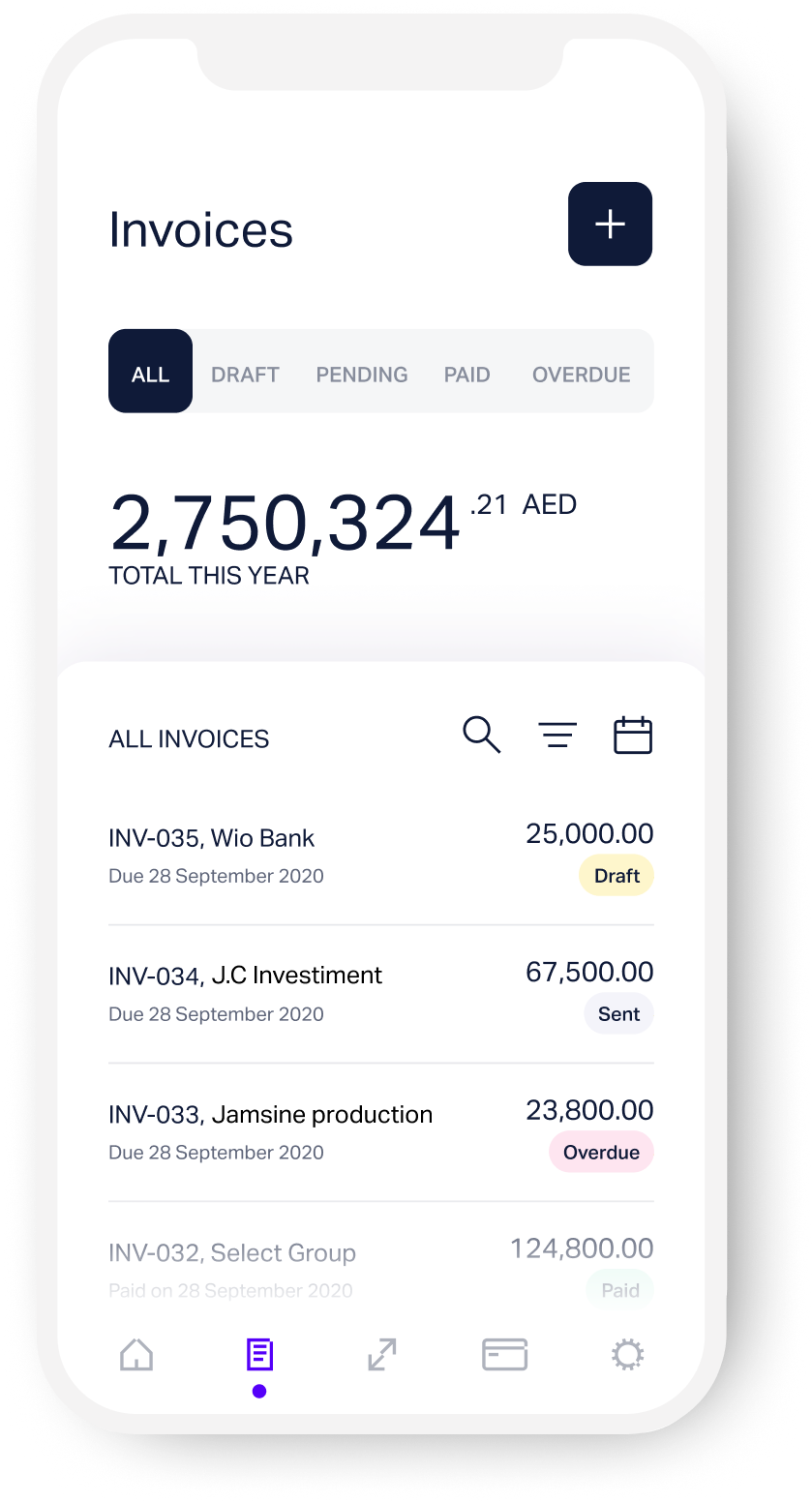

Create and share virtual cards for every project, instantly send invoices, pay your team on time with WPS for free, and sync effortlessly with Zoho Books, Fiskl, or Wafeq.

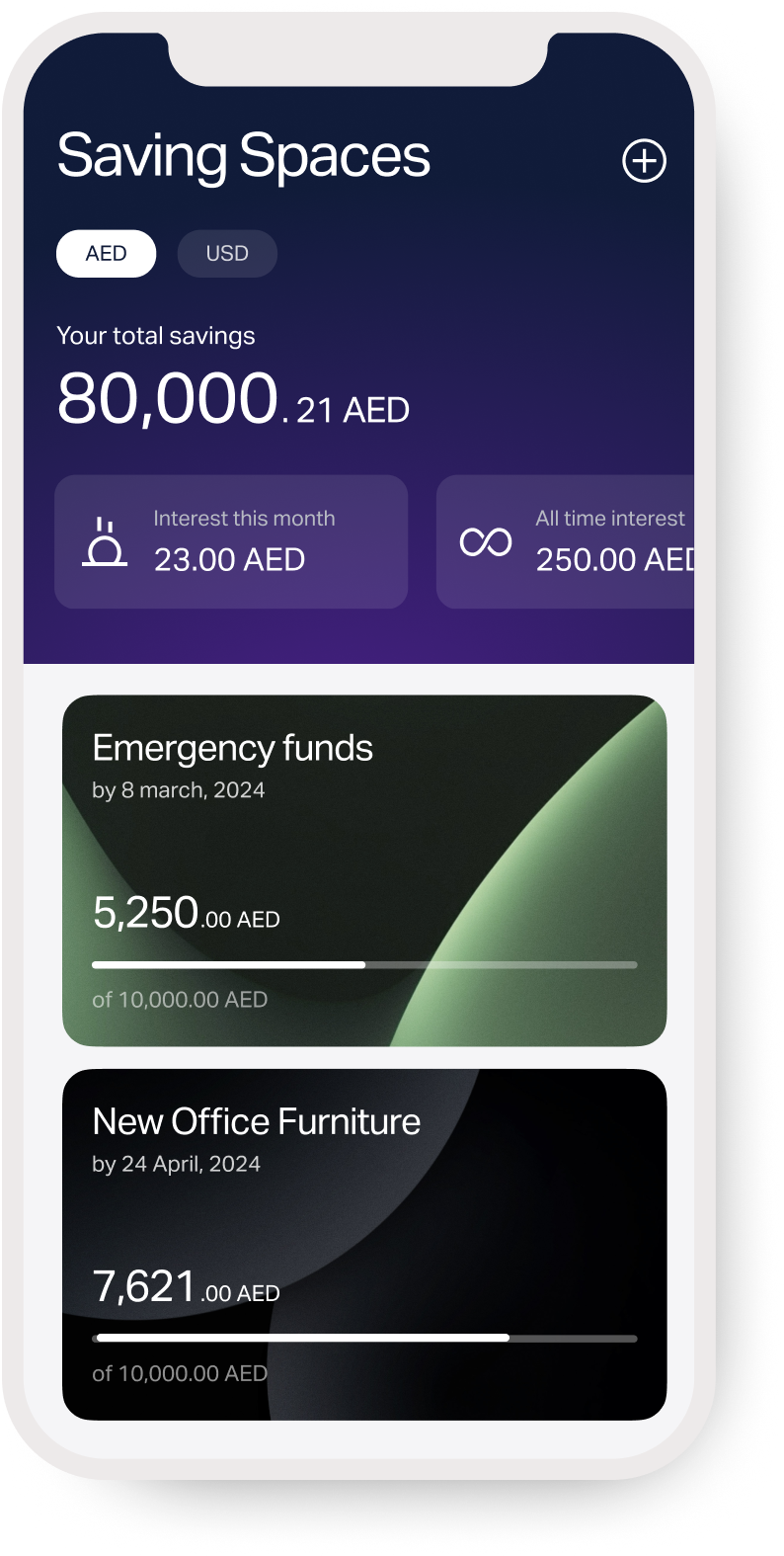

You work overtime, so should your money

Save smarter and earn up to 4% p.a. with Savings Spaces. Flexible terms, no minimum deposit, and access your funds anytime—without heavy penalties.

*T&Cs apply.

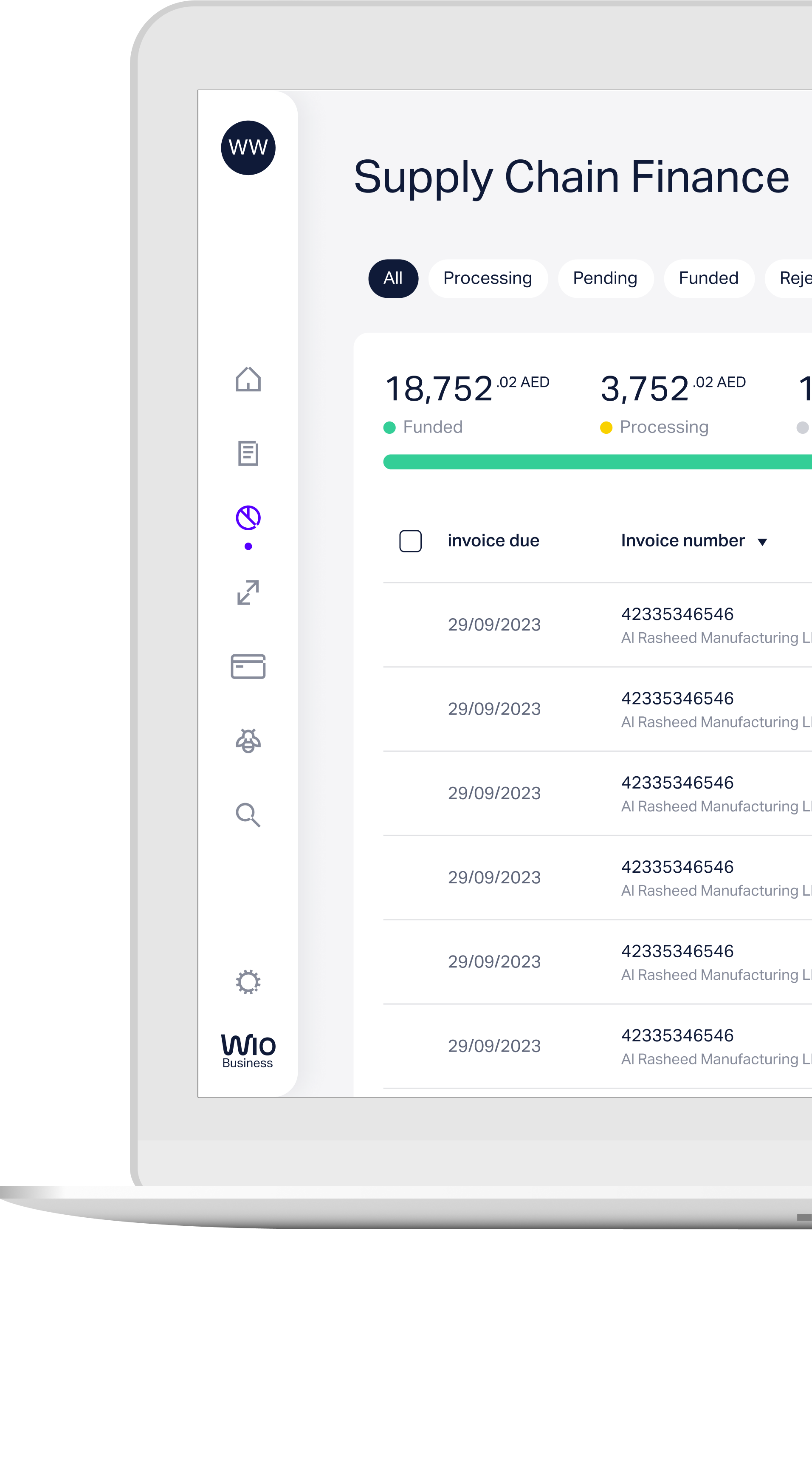

Your business deserves more than one way to grow

We’ve got financing for every business need:

*T&Cs apply.

No matter the size or stage of your business,

Wio Business is built for you.

Say hello to the future of business banking

Get perfect-fit plans to supercharge your business

Our account plans are designed to give your business everything it needs to grow

Accounts

Minimum monthly account balance

Nil

Multi-user account access

2 users free (Essential)

(AED 26.25 per additional user a month)

Account Closure (Within 6 months)

Free

Statements & Others

Audit confirmation letter

AED 105

Balance / Account confirmation letter

AED 105

Signature confirmation letter

AED 105

Liability Letter / No Liability Letter

AED 105

Paper statement

AED 26.25 for each 3 month account statement

Expired trade license fee

AED 210 per month (two months after expiration)

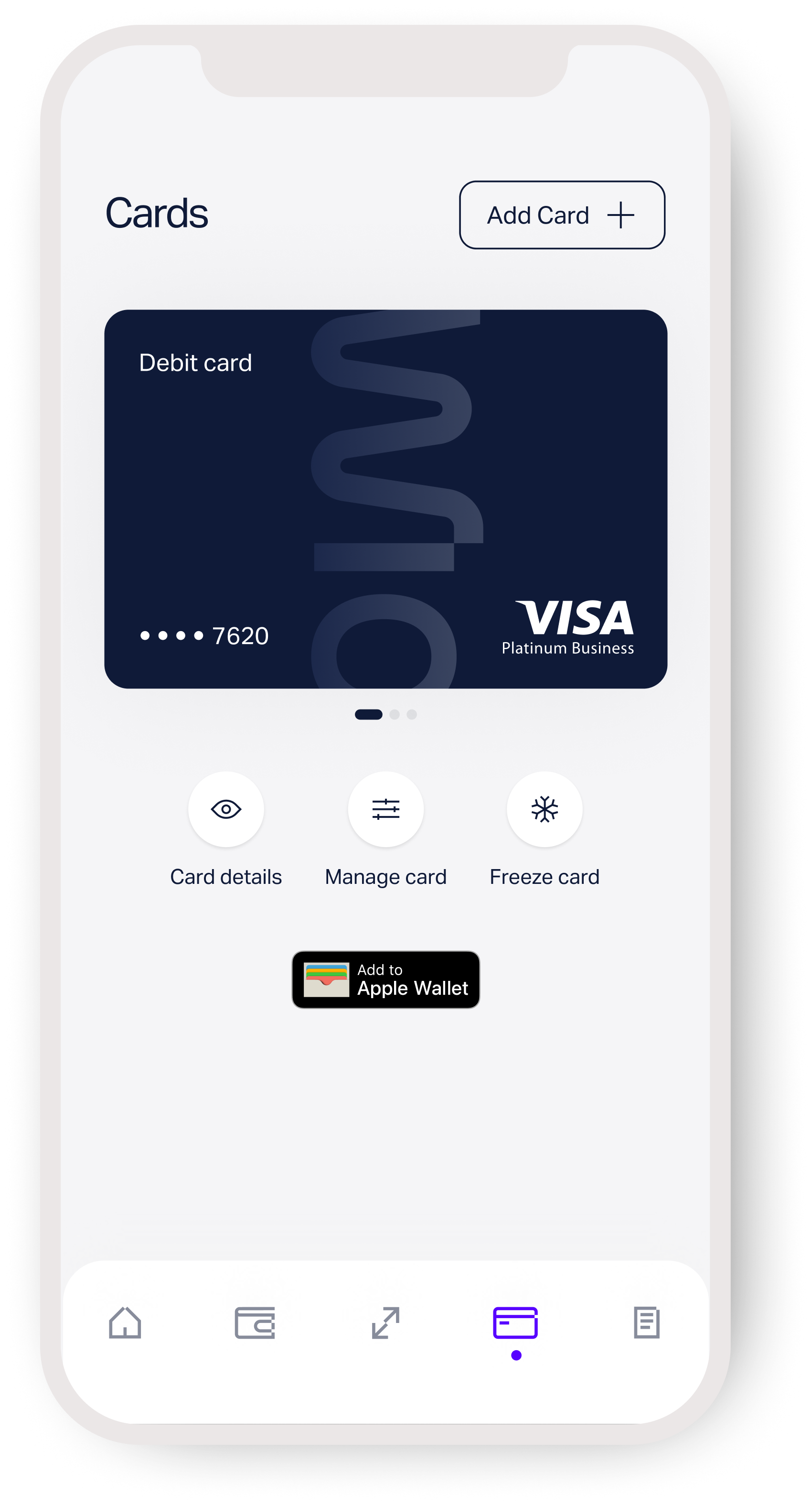

Cards & payments

Wio Visa Business Debit Card

Free (replacement for AED 26.25)

Virtual cards

Free

Wio Business Credit Card:

Roll over interest: 3.45% per month

Late fee: 199 AED (incl. VAT)

Annual fee: free

Quick Cash:

1.5 AED per 1,000 AED per day

Late fee: 199 AED (incl. VAT)

International transaction fee*

2%

*All transactions (AED and non-AED) originating outside the UAE (including online merchants)

Local transfers

Free

Swift international transfers

AED 52.50

Correspondent banking international transfer fees

Wise international transfers

Wise fees apply

Rewards

Cashback on credit spends

2% on all credit spends

Capped at AED 2,000 monthly (till March 31, 2025)

Cash & cheques

Cash withdrawals & deposits (FAB ATMs)

Free

Cash withdrawals (Other UAE ATMs)

AED 2.10

Cash withdrawals (GCC ATMs)

AED 6.30

International cash withdrawals

AED 21

Cash deposits (Lulu Exchange)

AED 10.50

Cheque book

One free (AED 10.50 for 10 leaves & AED 26.25 for 25 leaves)

Returned cheque

AED 105

Stop cheque

AED 52.50

Cheque copy

AED 10.50 per copy

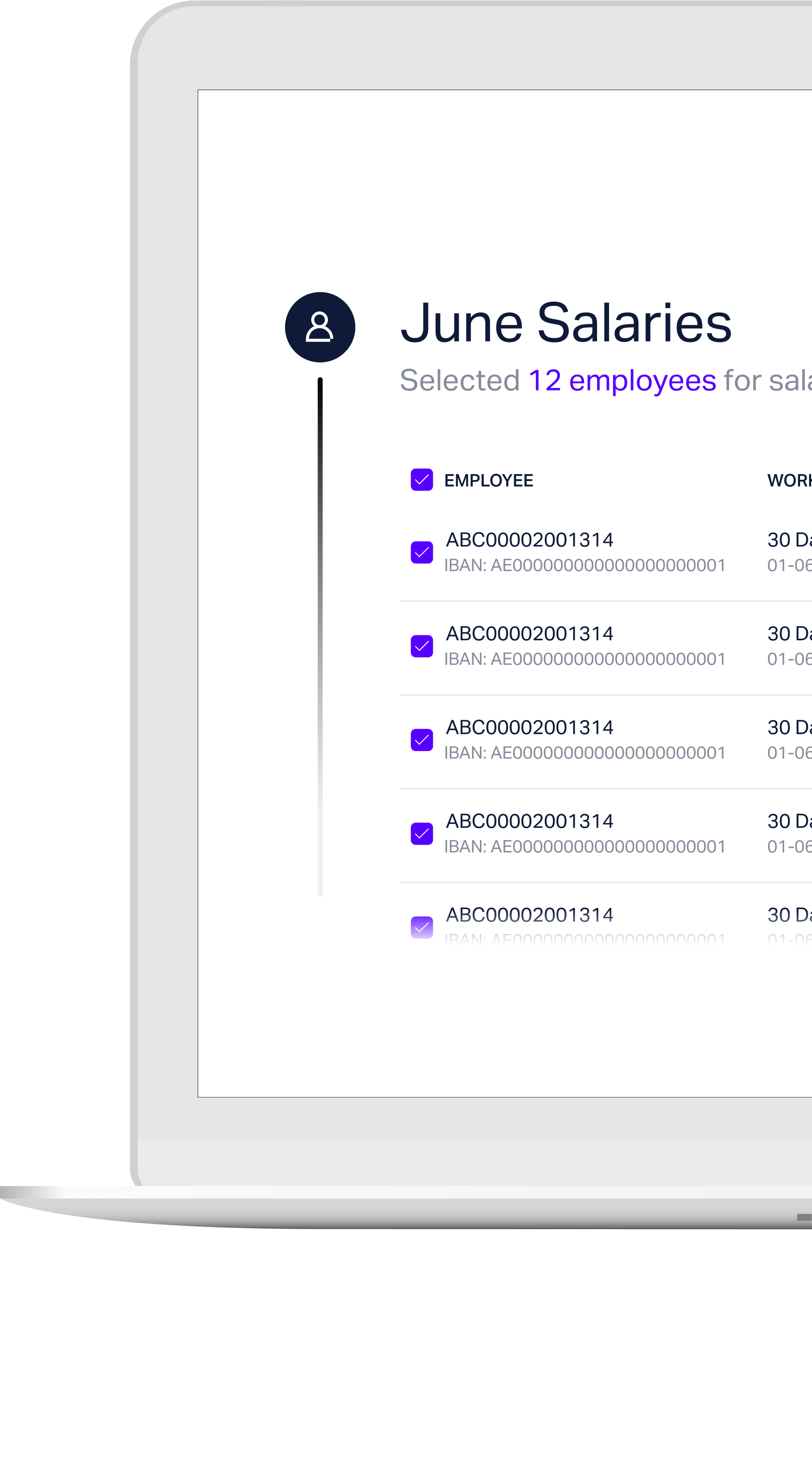

Beyond banking

Salary payments (WPS)

1 file free per month (AED 31.50 per additional file)

Invoicing (AED)

Free

Stripe payments

Free sign-up (Stripe fees apply)

Understand how this works

Terms & conditions

Monthly account fees

Correspondent banking fees

This Price plan is effective from 14th February 2023.

Are you eligible to open a Wio Business account?